What We Offer

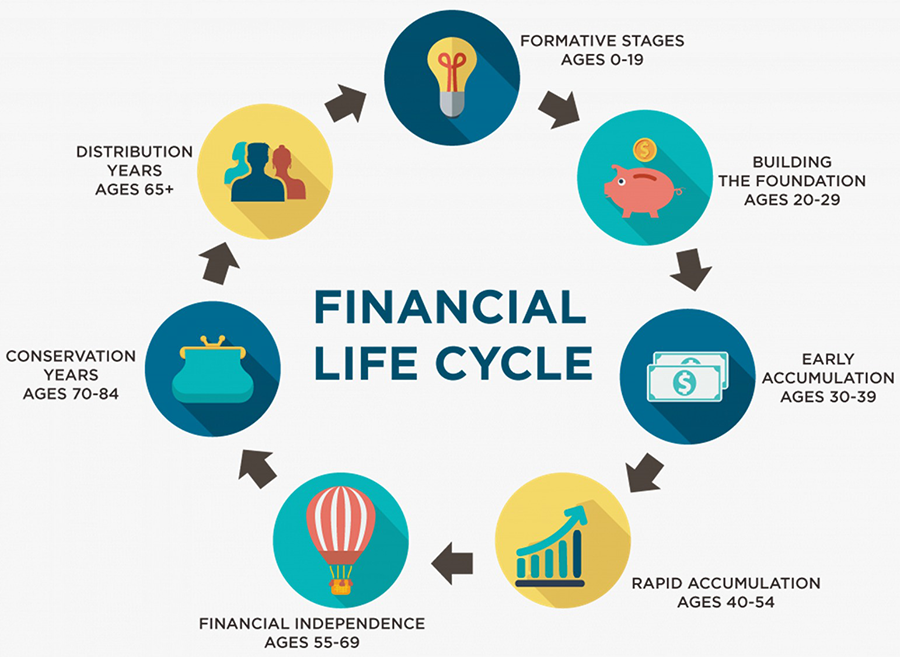

We offer a Platform, Services and Tools at Every stage of your Investment Life Cycle

Our RRLT-G Framework

For Comprehensive Composite Planning Contact us

Start Smart

Building a strong financial foundation starts with disciplined saving. We guide you in setting aside money wisely, ensuring you’re prepared for both expected and unexpected life events.

Dream Design

Begin your financial journey with a solid plan tailored to your goals. At PNS INVESTMENT, we help you identify your short and long-term objectives, whether it’s saving for retirement, buying a home, or funding education.

Wealth Blue Print

Our time-tested investment approach is built on the RRLT-G Framework, ensuring harmonious balance between:

R – Risk

Managing risk to protect your wealth

R – Return

Optimizing returns to grow your wealth

L – Liquidity

Ensuring access to funds when needed

T – Tenure

Time duration for Each Goal

G-Goals

Aligning investments with your Short, Medium, Long term, Retirement goals

The benefits are Balanced portfolio, Risk mitigation, Tailored solutions, Flexible liquidity, Goal-oriented investing to secure your family’s financial future

Growth Accelerator

Grow your wealth by investing in options that align with your risk appetite and financial goals. From mutual funds to bonds and stocks, our expert advice ensures your money works hard for you.

Portfolio Pulse

Successful investing requires ongoing management. Our advisors regularly review your portfolio, optimizing performance and adjusting to market changes, so you stay on track toward your financial goals.

Golden Years

Distribute your wealth strategically to meet future needs. Whether it’s planning for retirement or passing on assets to loved ones, we ensure your wealth is efficiently allocated and protected.

Services offered

- Risk Profiling for Self and Family

- eKYC for mutual Fund and Stock Investing

- Registration in SEBI approved ONLINE Transaction Platform (Free)

- FREE Android or iOS based Mobile Application

- Analysis of Existing Portfolio and X Ray report-by appointment

- Portfolio Management, Monitoring and Reports

- Tax Reports

- Asset Allocation and Portfolio Balancing yearly or Half yearly

- PMS and AIF Products Selection and Distribution

- Multi Asset Dash Board

- Offering of other Products like Small Case, Insurance, NPS, P2P loans, Bonds and Unlisted Shares

- Retirement Planning, Composite Goal Planning and Analytics using Advanced Tools and Research Platforms